Scott Higgins, Pepper’s Senior Vice President of Preconstruction, is an industry expert and thought leader when it comes to forecasting the impact that pricing and supply restrictions will have on the construction market. In the blog below, he shares his thoughts about where things may be headed over the next year.

As we progress through the first quarter of 2023, the outlook for the year is still less than crystal clear. It should be more predictable than last year, however the very meaning of volatility and unpredictability continues to change. So, where does that leave us? My opinion: We are still in an environment that includes inflation, supply chain questions, labor shortages, and the potential for recession.

When I look back, 2022 was another year of constantly re-framing how we approach our work and re-adjusting to new realities as they developed. Making our projects predictable is harder today than it was three years ago, as the variables that impact project results have multiplied and changed.

We have continued to seek answers for ourselves both openly and transparently. This past year, we shared with our clients and partners a video series that was originally designed to educate our staff. Topics have included how current events impact the construction industry from multiple angles: commodity and material pricing, labor and material availability, lead times and schedules, alternative systems and even touched on crypto-currency's impact on available energy. We’ve called the series PRECONversations and the videos can be viewed here.

It is clear that lead times and prices went up. Exponentially in some cases. As we consider the outlook for 2023, here are some of the questions that remain on everyone's minds:

- Will prices come back down?

- Will lead times decrease?

- Will there be a recession or a construction slow down?

Answering these questions requires both a historical view and a crystal ball. Unfortunately, I don’t have the latter, so I can only share my opinions.

Getting insights and perspective from context

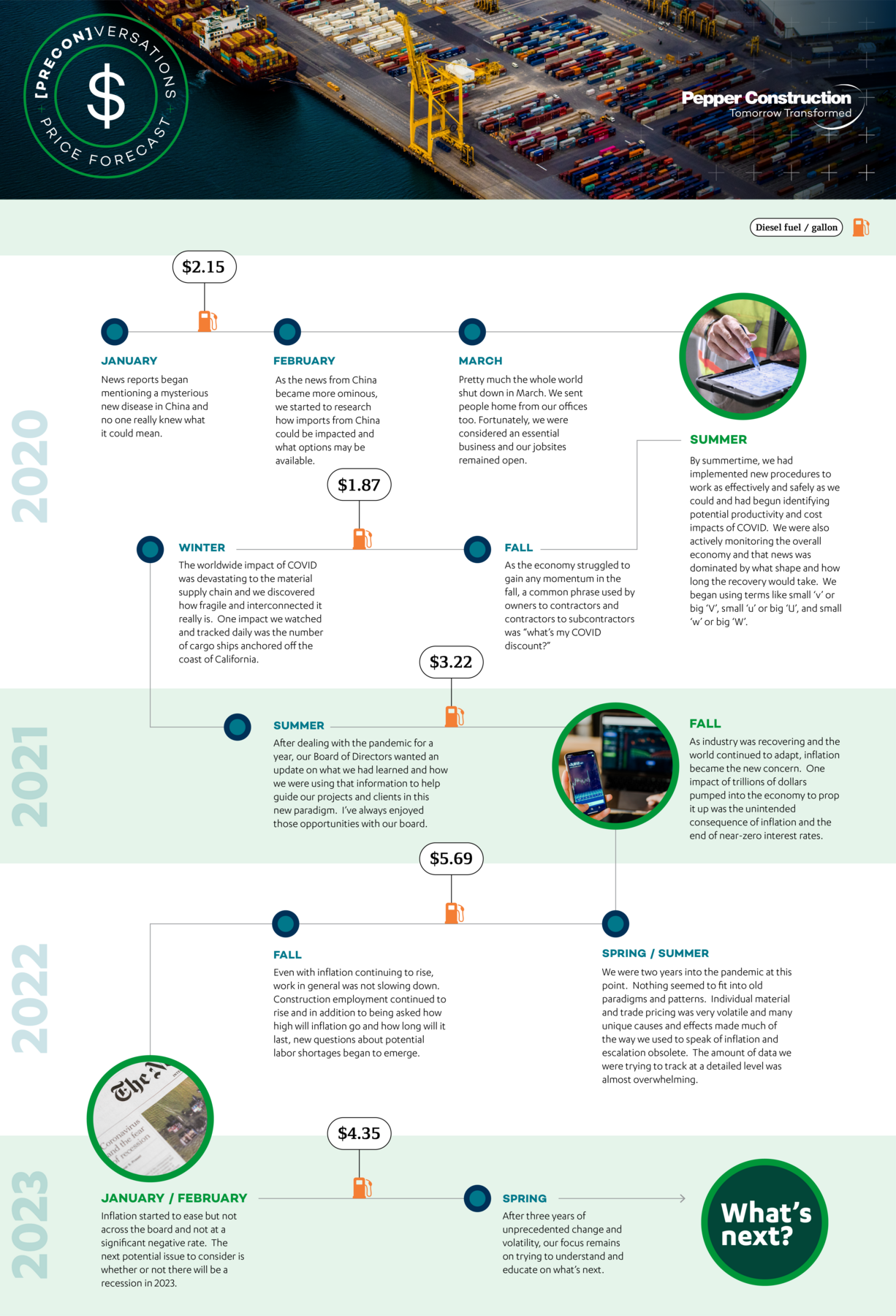

Our world is different today, even from when Covid-19 first showed up. In January 2020, when the virus was still only in China, we started considering how much longer it would take to make and receive materials and equipment. We thought we were being forward-thinking. Within two months, Covid was here, and everything was shut down. We all experienced how small our world is and as we repeated, “We’re in this together,” we realized how connected we are to each other.

The construction industry adapted well to different ways of working amid lockdowns, and we were fortunate to be classified as an essential business in most states, which meant that we were able to continue working on our jobsites while other businesses were forced to temporarily close. But as we continued to overcome hurdles such as figuring out how to build while remaining six feet apart, we were met with supply chain and procurement challenges on the other side of the construction equation. Below is how I remember several of the key milestones landing along the timeline of the past three years.

Before Covid, our industry was accustomed to everything being consistent. If there was a slowdown, everything slowed down. Commodities, materials and labor moved together in unison, which is why we could more simply apply escalation rate variables.

Have we entered uncharted territory?

I hate to use the term new normal, but we are now doing business differently than three years ago. Goods and services cost more and are likely to continue to cost more and take longer to receive than they did previously. The meaning of long-lead items and the idea of looking ahead are different now.

Every piece of a building has its own story, and the factors that affect the price and schedule vary by material. We now look at inflation, supply chain, geography and market on a more micro level.

The good news about the inflation roller coaster is that the rate of increase slowed at the end of the year and continued in January. Just as we heard “flattening the curve” during COVID, that’s what we are seeing now with inflation. The rate of increase has slowed dramatically in the last several months. There are a few prices that have come down as well. We will monitor this closely throughout 2023 to look for trends on what is still going up in price, what is coming down, and what is remaining flat.

Given the continued vulnerability in the market, what changes can owners expect to continue?

- More emphasis on early decisions and early procurement

- More collaborative and close coordination with the field. There will be fewer clear-cut hand-offs, as the field perspective is critical to the procurement and schedule.

- Still look for months vs weeks for procurement of many materials and equipment. Though not the story of the day, supply chains are still a concern. Even as smaller item availability becomes easier for procurement and delivery, large equipment can still be a year out.

- Continuous learning will allow us to react and adapt, which is critical to our continued success.

More knowledgeable and sophisticated owners and larger construction firms are used to the extra planning and monitoring that are required to manage projects successfully. They understand cost and schedules have changed, and anyone they are working with is telling them to expand and look at alternate phasing and materials and to make decisions earlier and faster.

However, the smaller GCs, trade partners and “Mom and Pop” companies may treat the situation differently, without the resources and the business stability that, somewhat ironically, allows them to be flexible as the market rolls and reacts. The situation is particularly concerning at a time when we are trying to grow our base of diverse trades, including minority and women-owned businesses, and provide fair and equitable opportunities for all to be successful.

The $1,000,000+ question: Will prices come down?

Commodities have moderated from their highs, but bid prices remain high for two reasons.

- Demand is still high.

- The trades are trying to recoup losses from 2020 and 2021.

I believe in taking an historical view to forecast the future. It keeps the overall outlook positive amid challenges and downturns. So, if history repeats itself, what can we expect?

Inflation will continue to moderate and ease somewhat. We anticipate a gap between material prices and bid prices until inflation calms. Historical evidence suggests interest rates will increase until they are higher than the rate of inflation. And, when looking back at interest rates over the last decade, where we are now is an historical average.

For owners evaluating how to move forward with a project – and remember, we don’t have that crystal ball – I’m suggesting they move as quickly as they can. Waiting won't make it cost less or take less time. If there is a recession in 2023 that is deeper and longer than predicted today, prices could fall. But if it’s a typical recession like we have seen before, it won't significantly impact pricing or delivery.

What are the biggest challenges our industry will face in the short-term?

In addition to looking at the “big picture” issues like recession fears, we also need to work with and around the obstacles in our immediate path.

- Getting preconstruction right.

- By allowing adequate time, resources and early collaboration, we can better control the outcomes during construction.

- Finding innovative ways to adapt to supply chain issues.

- Beyond staying in front of shifting lead times for material and supply manufacturing and delivery, we must remain diligent and creative to ensure that projects don’t take more time and cost more money.

- Addressing workforce shortages.

- The construction labor force is aging, and new laborers aren't entering as fast as seasoned people are leaving. It will be interesting to see how different entities and companies come up with new ways of training, educating and enticing people to join the construction industry.

- Competing for talent.

- Despite major layoff announcements from key employers in recent months, the U.S. economy still has over 10 million job openings. And contractors are still competing to hire the best talent.

- Facing pain at the pump.

- While fuel prices have come down for the average consumer, with unleaded gas close to or under $3 a gallon in many markets, diesel is only down 30 cents. There is a big difference in the price of gas vs diesel, and diesel is what we use in construction. Additionally, as gas tax moratoriums retire, we expect to see costs increase.

What impact will we see over the long-term?

When I look at graphs about historical inflation and recessions, about the only thing that doesn’t change is the way things change. If history is an indicator of what to expect, everything balances out over time.

- Recession - we already experienced the standard definition of two quarters of reduced GDP in the middle of 2022, and it wouldn't be surprising to see it again. The Architectural Billing Index (ABI) is a monthly economic indicator for nonresidential construction activity, with lead times of approximately 9-12 months. Data is gathered through a survey conducted by The American Institute of Architects (AIA) that analyzes shifts in billings from architectural firm leaders. Most recently, the ABI was down three months in a row after 20 months of increases, and there are other signs that a slowdown – hopefully not significant – may take place in the second half of 2023. Construction starts were up in 2022, and that will carry over into increased construction spending in 2023. New construction starts in 2023 will be a key indicator to follow.

- Inflation - Over the long-term, inflation in construction averages 3.0 to 3.5% per year. The years 2021 and 2022 saw double-digit increases in many prices and while inflation may be more volatile now, it hasn’t changed over the long-term trajectory. Smaller increases and reductions in some prices are likely in the near-term.

- Oil - The price of oil will follow the economy. It was over $90 during the second half of 2022 and is under $80 in late February 2023. I don't see anything significantly impacting oil until the next election.

- Stock market – Since 1962, the average increase in the stock market the year following a mid-term election has been 13%. I think we can all agree that 13% would feel really good right now. The S&P 500 is up 6.5% and over 4,000 in early 2023, so we’re off to a good start. The predictions for the end of the year range from 3,400 to 4,500 with the average at 4,009. The pessimists and optimists are equally divided, which makes it even harder to say with any certainty what is going to happen.

- Regulations - With changes in Congress, there will be more gridlock than anything else, as we have begun to see. The economy typically likes balance and a divided government, so not much will happen.

- Covid-19 - Teams are accustomed to dealing with Covid. We have learned to react and adapt, and I don’t see Covid impacting productivity as we move forward.

What's trending: Paving the way for progress

No doubt, we have been forced to innovate at an accelerated rate - to find ways to re-sequence the work and find new procurement strategies. Through all the challenges, I believe our industry is becoming more forward-looking. While cost will always be one of the main drivers, technology will play an ever-increasing role as we look for new ways of building, gaining efficiencies and addressing both the short and long-term challenges.

Another topic that has quickly gained importance for many clients and must be considered as an essential factor in preconstruction discussions is the health and resiliency of our buildings. We’re seeing growing interest in alternative energy, adaptive reuse and other high-performance solutions. In fact, Pepper believes that sustaining the health and wellness of our world has never been so urgent – or so attainable. That’s why we have made it our brand commitment to see Tomorrow Transformed. As proven experts in high-performance and sustainable building, we believe it is our responsibility to share our knowledge and catalyze the industry to build cleaner, smarter and healthier on behalf of our planet.

These environmental factors will continue to be part of the mix as we weigh solutions against pricing, production, delivery and other variables that continue to change and evolve. If you have been following the PRECONversations video series that I mentioned at the beginning of this article, you have probably already noticed the inclusion of this theme. Beginning in March and moving forward, our videos will be transitioning into a podcast that will be further supported by an e-blast that will provide both quantitative and qualitative information on a specific topic from the broad field that continues to impact preconstruction price forecasting. You can register here to be updated on future content and receive insights on a monthly and quarterly basis.

I look forward to sharing future thoughts and materials with you as the year progresses. One of these days I may even be able to get my hands on a crystal ball. Until then, I’ll keep a close watch on what’s happening, assess it against what we’ve learned from previous industry challenges and share whatever trends I can identify and insights I can make.

About the Author